2nd edition of: "Dimensional Scaling and the SRAM Bit-Cell"

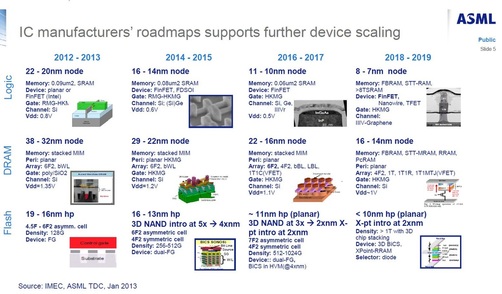

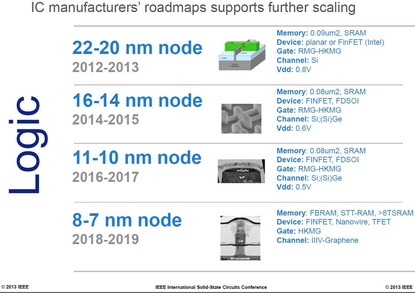

I just downloaded the ASML presentation from Semicon West2013 site - ASML's NXE Platform Performance and Volume Introduction. Slide #5 - IC manufacture's road maps - says it all.

In our previous blog (attached below) that followed ISSCC 2013 we saw some early indication of this slowdown. Yet we were still surprised to realize how bad it really is. This might explain why after resisting IBM and other pushes for embedded DRAM, Intel announced few month ago that its Haswell processor will incorporate embedded DRAM after all.

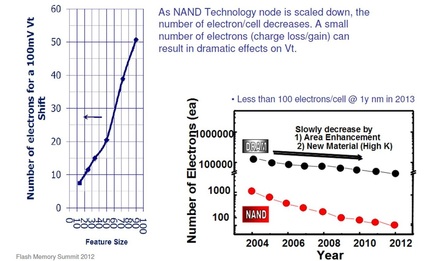

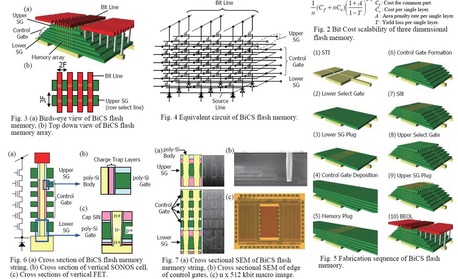

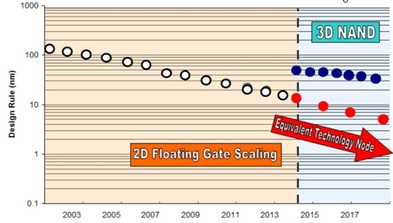

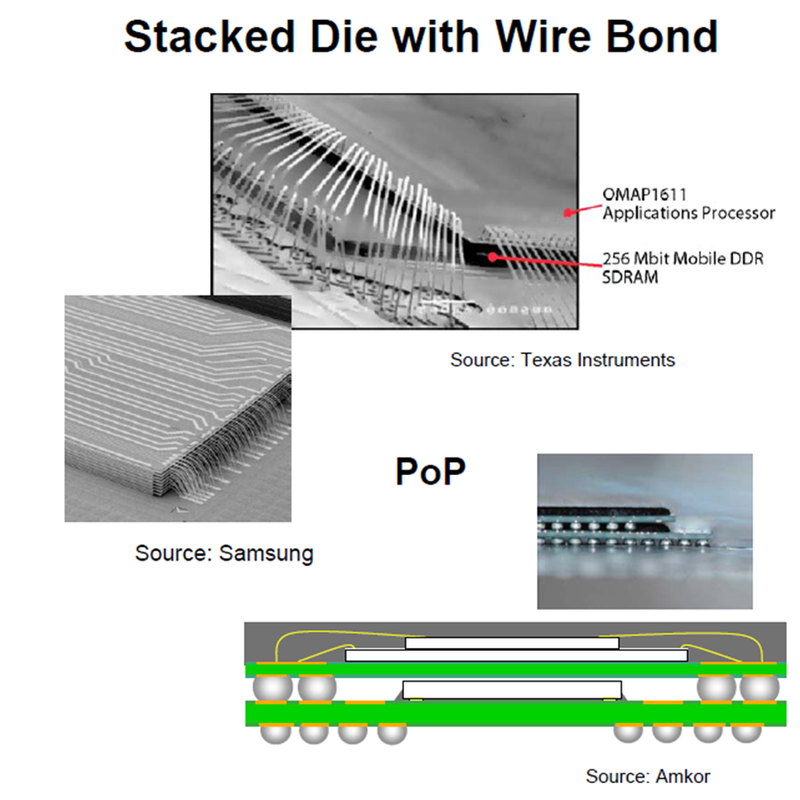

Another point from this ASML slide is the adaption of monolithic 3D by the NAND Flash vendors. We believe this is a start of a trend, and that logic vendors has now one more reason to follow it.

Previous Blog:

One Thing that ISSCC 2013 Highlighted to Us

Dimensional Scaling and the SRAM Bit-Cell

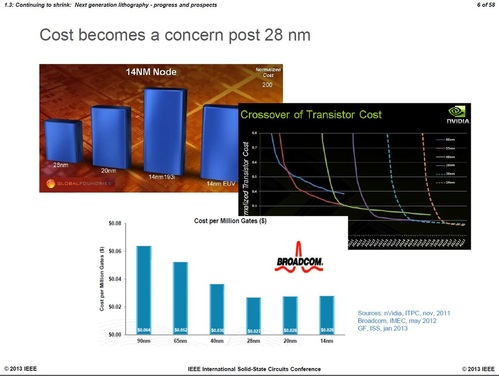

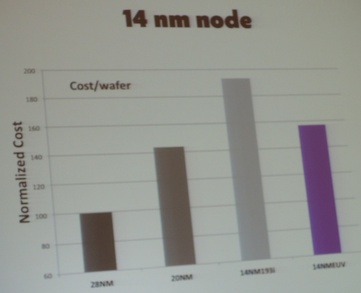

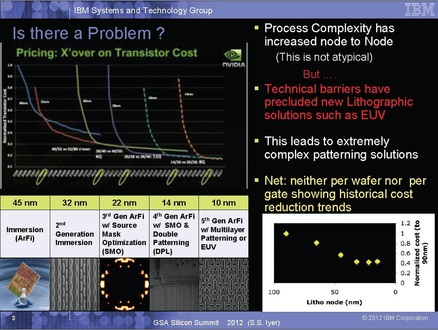

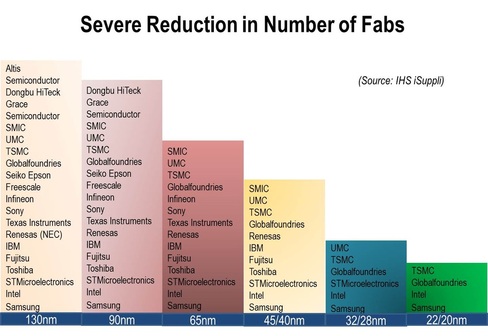

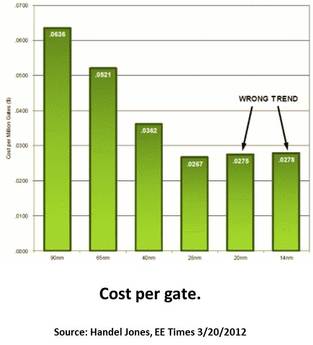

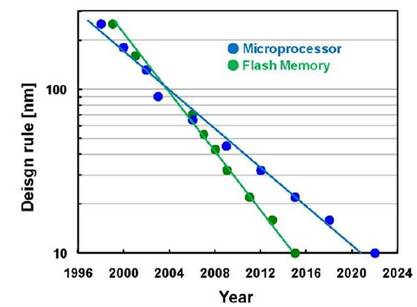

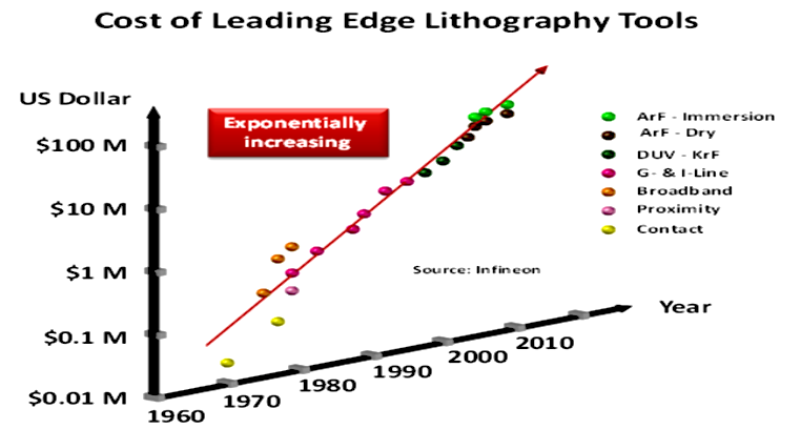

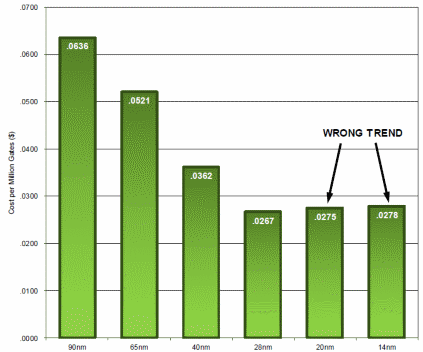

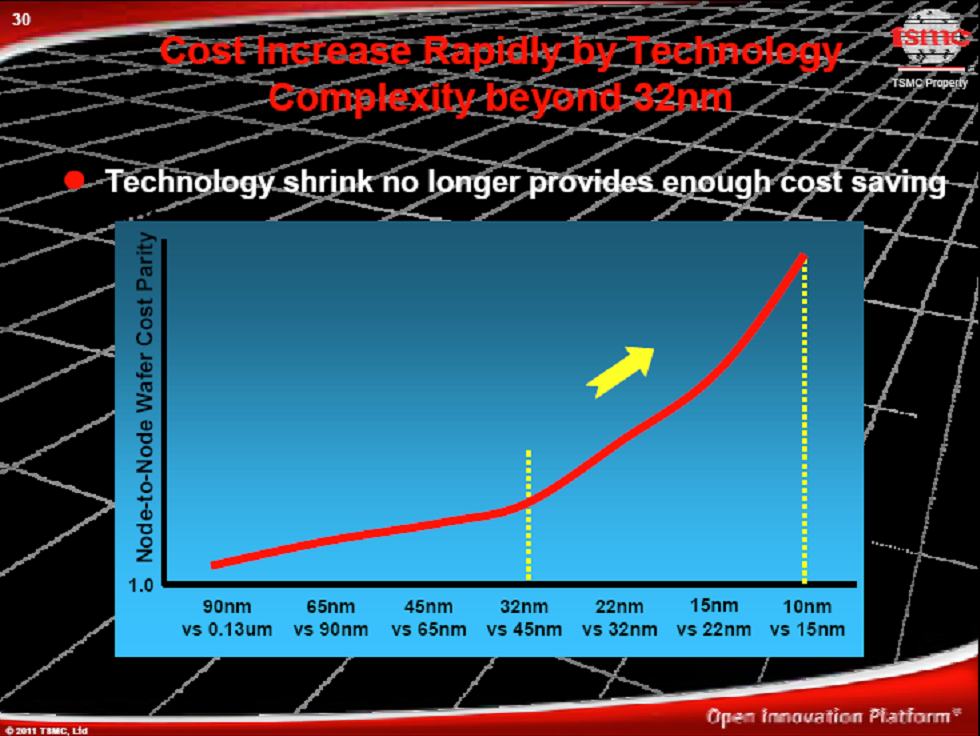

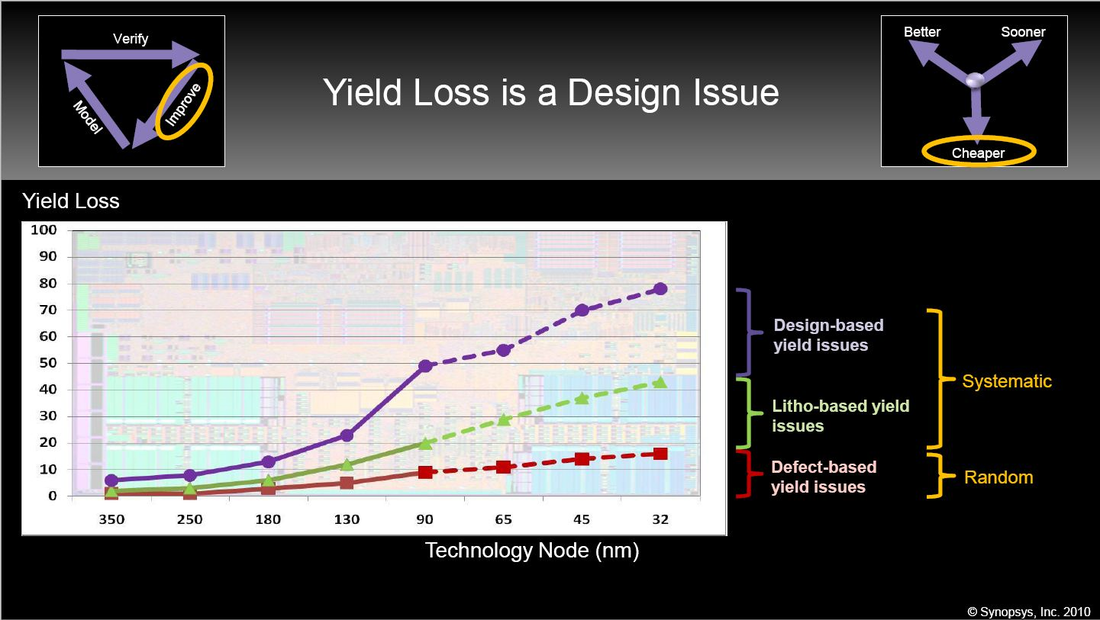

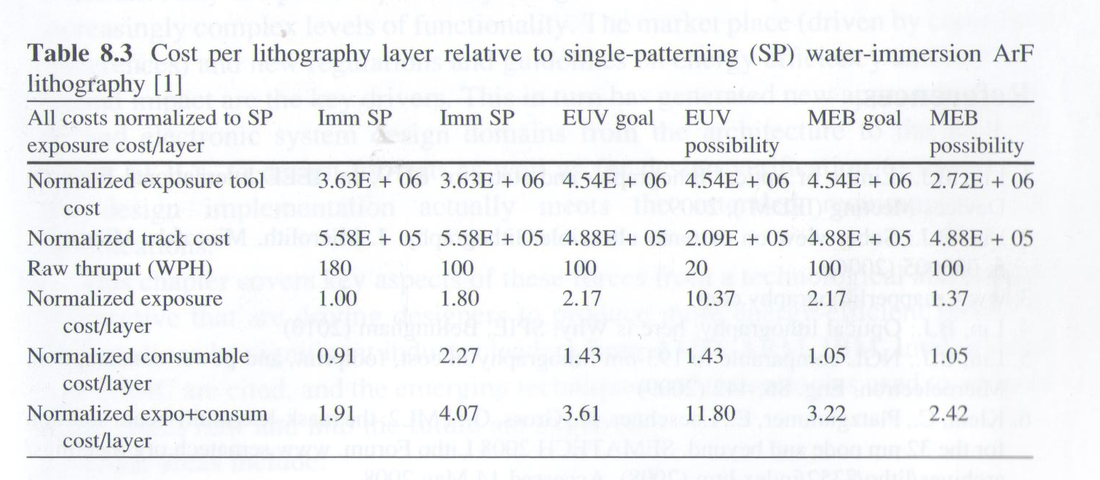

As widely reported in the industry and articulated by ASML’s Executive VP & CTO Martin van den Brink at ISSCC 2013, there is substantial evidence that without EUV the cost of logic transistors is most likely going up with scaling. One slide he used to illustrate this is below:

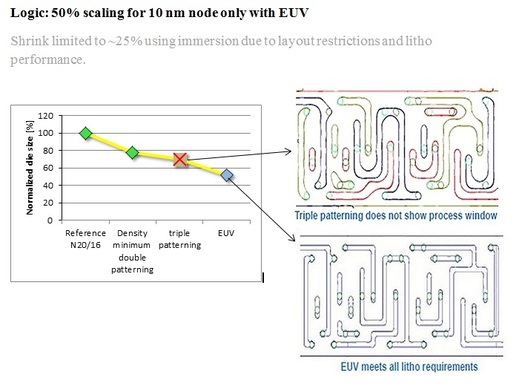

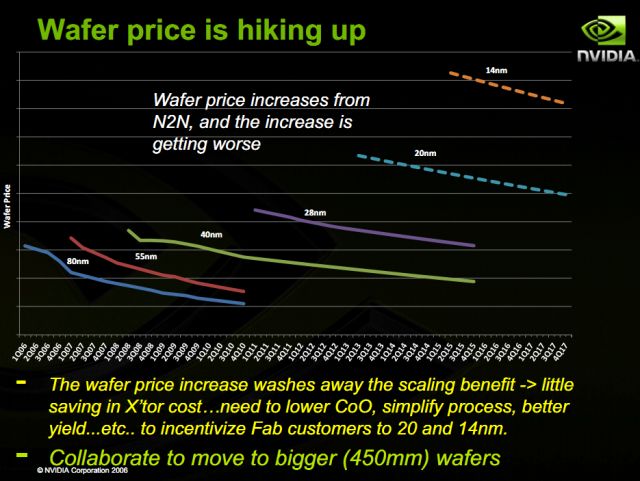

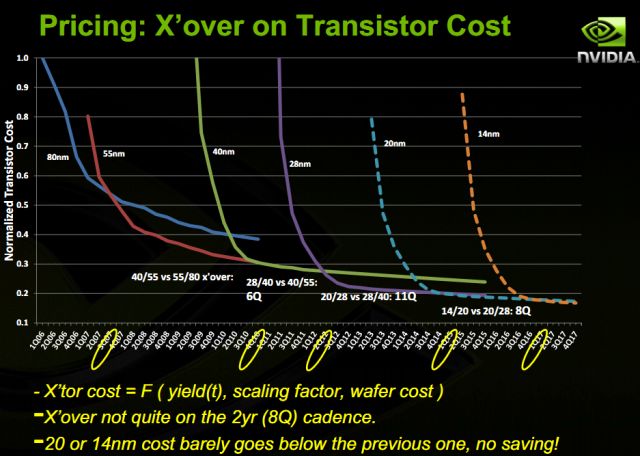

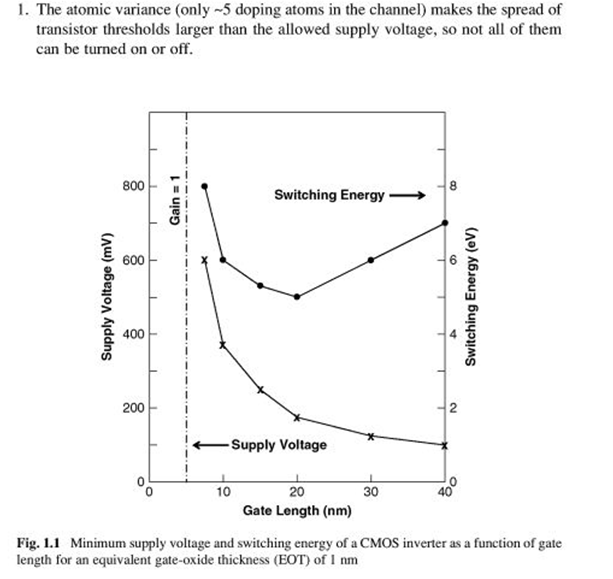

An even more interesting slide was presented by van den Brink:

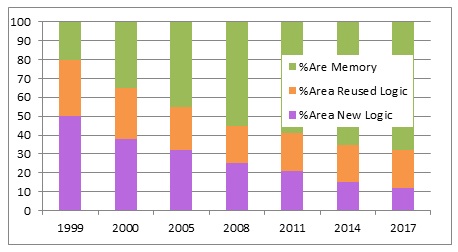

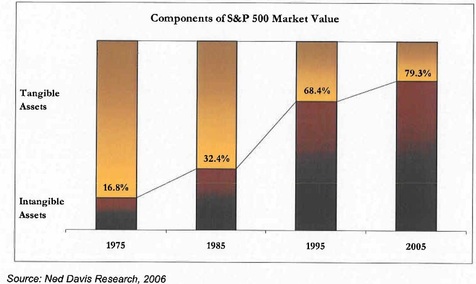

Modern logic devices demand a significant amount of embedded SRAM. In fact, more than 50% of the typical logic device area is allocated for these SRAM as illustrated by the following chart of Semico (June, 2010)

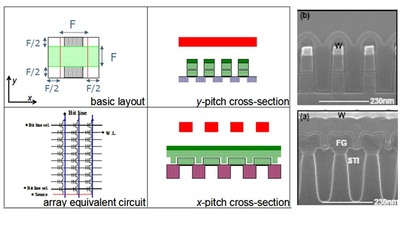

It well known that scaling the SRAM bit-cell has become harder and harder. Some vendors have already moved away from the 6T bit-cell in preference to the 8T (eight transistors) bit-cell. ISSCC 2013 had a significant number of papers that were presented using 8T SRAM. The few papers who kept the 6T SRAM embedded in their logic devices were forced to add read/write support circuits and additional overhead to enable the 6T bit-cell to function reliably.

Since SRAM bit scaling is now not able to keep up with logic scaling, the overall end device cost scaling could be even more disappointing than the transistor or gate cost illustrations above.

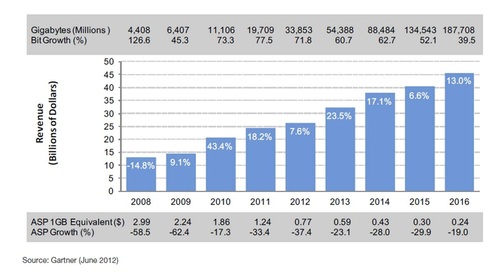

Of course, well aware of this trend, IBM has been promoting their embedded DRAM solution for years. In the recent Common Platform Forum Dr. Gary Patton, VP, IBM Semiconductor R& D Center, was very pleased to share that in their 32nm product line the use of the embedded DRAM has given IBM the equivalent of a process node scaling benefit. Yet, as of now, most other vendors have not adopted eDRAM due to the process complexity and cost it adds to the logic process. It fair to assume that the appetite for eDRAM will not grow with dimensional scaling as the DRAM capacitor will be very hard to scale, the extra power for supporting DRAM will not be available and the cost of advance process development to add in extra complexity will be too high.

Accordingly we can learn from the recent ISSCC that dimensional scaling is facing the cost challenges we were aware of before in addition to new challenges that we might not have been aware of: the cost and the active/passive power handicaps due to the incompatibility of the 6T SRAM bit-cell with scaling.

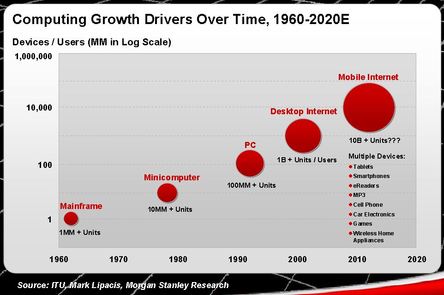

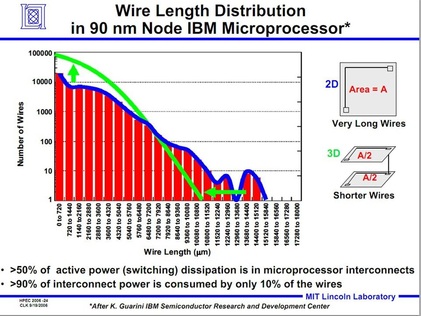

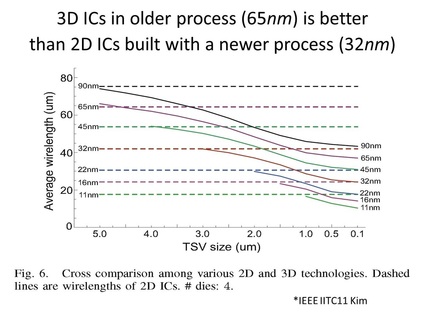

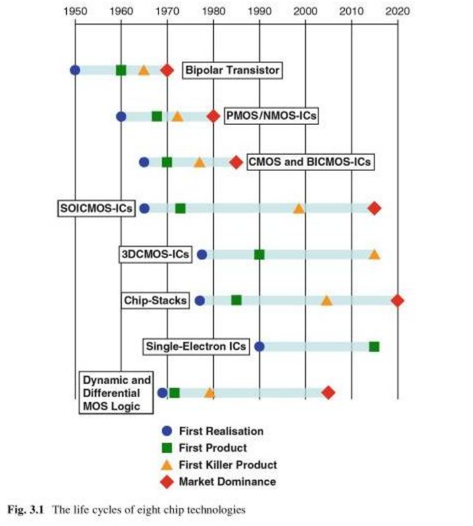

As we have suggested before, now that monolithic 3D is practical, we could advance and maintain Moore's Law by augmenting dimensional scaling with 3D IC scaling. We could enjoy depreciated equipment charges for more years and much lower R&D engineering outlays that would bring down production and development costs, and also enjoy improvements to power and performance.

Another exciting option is to replace the 6T SRAM bit-cell with the 1T bi-stable floating body memory cell invented by Zeno Semiconductor. The Zeno bit-cell provides two stable states, analogous to an SRAM while only consuming ~20% area of a traditional 6T SRAM and requires considerably less power. The area and power savings over a traditional 6T SRAM improve further with scaling. Most excitingly the Zeno bit-cell is compatible with existing logic processes.

RSS Feed

RSS Feed