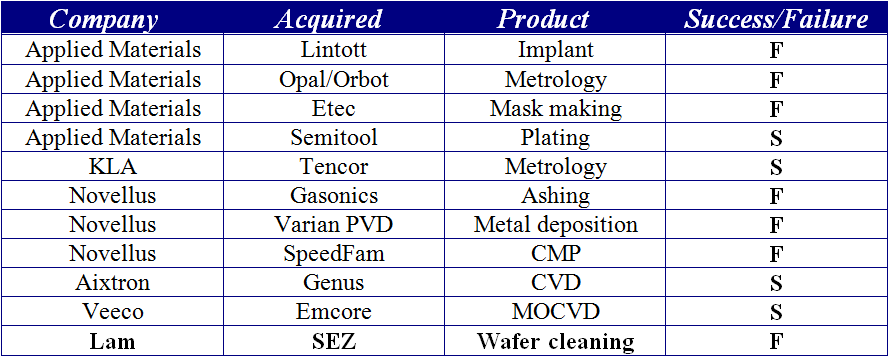

The equipment business is relatively conservative and for many years only few noticeable successful M&A were done. Few past M&A were of a strategic nature. In these cases a large corporation buys a smaller one to either develop a product line or to buy into a growing product line. Table 1 is a snapshot of some past M&A activities in the short history of the semiconductor equipment industry-by far not a complete list.

Going back to the two recent M&A namely Applied Materials Varian and Lam Novellus the question is how this will affect the semiconductor industry and who is going to benefit from it.

I definitely view these two activities in a positive way.

1. Applied Materials and Varian: Looks like Varian had practically all the implant market and really didn’t have any room to grow (beside the new solar implant business-highly speculative). So selling the company to Applied Materials helped a lot… the employees and the top executives that suddenly got their stock price almost double…From Applied Materials point of view they now controlling most of the front end equipment and can influence the transistor technology more than before. Though I might emphasize as I mentioned in a previous Blog that the percentage of the implant business in the whole semi CapEx pie is shrinking in the last few years and probably with the introduction of the FINFET-Tri gate it will shrink even more. Still for Applied strong position in the Epi, RTP and Implant market they do have good position in the front end. The missing link of course is a good position in the ALD technology (controlled by ASMI).

In other hand customers don’t like to see too much power at the hand of one equipment vendor; they do like to see competition. Not clear how it will be played in the implant arena since no other real competitor in the horizon.

2. LAM Novellus: This merger was proposed many years ago and almost every year was rumored to go through without actually happening to the dismay of analysts and others. However eventually it did happen! By combining the winning position of Lam in the etch and Novellus in the CVD the new combined company could expand and offers new modules and combinations of products especially in the back end and in the emerging double (quadruple) patterning that becomes a very important module in the advanced lithography.

In order to complete this discussion we need to look at the future, and in the future new technology of 3D devices will become a reality. Let’s discuss now how these M&A will affect the new world of 3D devices.

- TSV

- No real effect from the Applied Materials Varian deal since the implant is only a front end technology. Not clear if the Plasma Doping (PLAD) that supposes to do material modifications has any impact in the back end.

- For the Lam Novellus deal it could enhance the TSV technology since they could bring a more comprehensive solution to the TSV module that will include the etching, deposition and Cu plating. Of course they are missing the market leading position that Applied Materials has in the Cu barrier seed PVD equipment.

- Monolithic 3D

- Since Applied Materials own now the implant business they could easily get involved in the smart cut technology from point of view of proliferate it to the rest of the world, as it is currently dominate only by the SOI wafers manufacturing. Owning the RTP and Epi helps well in the Monolithic 3D module.

- No real effect from the Lam Novellus deal.

- The future introduction of Monolithic 3D technology into the Fab present an opportunity to all the equipment manufacturing companies from several new tools that need to be proliferate into the process flow.

RSS Feed

RSS Feed