My explanation is that it is all about IP strength. I will expand on it in the rest of this blog but as prime evidence I offer SanDisk, who sports a P/E of 20.78 yet has continued to invest heavily, together with its partner Toshiba, in fab capacity upgrades.

Let’s first look at the previous two decades as Intel grew consistently year after year while riding the PC business growth. During those years the team Intel + Microsoft was the exclusive vendor in the PC 'game'. All others had to compete neck to neck in this fast growing commodity market. And as we all know, broad competition erodes margins and allows only the lowest cost producer to achieve some profits. In the case of PC this erosion actually pushed out the market creator - IBM - which eventually exited the market and sold its business to Lenovo. The only real winners back then were Microsoft and Intel, who had pivotal differentiating IP. Yes, Intel had a licensor - AMD - but as a licensor, AMD had to pay heavy royalties that impacted its profits, and helped those of Intel.

Both Intel and Microsoft were able to leverage there unique IP into years of growth and became the largest companies in their field.

But being the largest today does not guarantee the tomorrow. Or, as Andy Grove famously said, "only the paranoid survive".

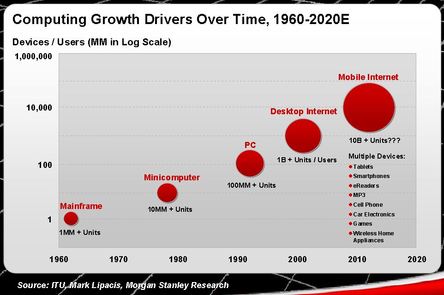

The technology world is about change. While many of the changes are incremental, at times the paradigm changes too. The change that took away Intel’s and Microsoft’s unchallenged market and IP position was the shift to "smart mobile," or mobile internet, as is illustrated in the following chart.

To make matters even worse, a small company - ARM - was able to create a disruptive change in the computing engine with its preferred computing architecture, first for 'smart mobile,' then for tablets, and now it seems to penetrate the PC and the server markets.

In my view, as soon as the investment community realized that Intel’s exclusive market and IP position is not relevant to the new market of Mobile Internet, it started to tune down Intel’s P/E. This trend even got stronger as investors became concerned regarding Intel’s position in the PC and server market.

It should be noted that in this context IP is not counted by the number of patents or the amount of trade secrets but rather by the ability to exclude competitors from major markets or extract royalties from those competitors, which may make you a winner even when you loose business. This is a status that Qualcomm and other companies such as SanDisk enjoy.

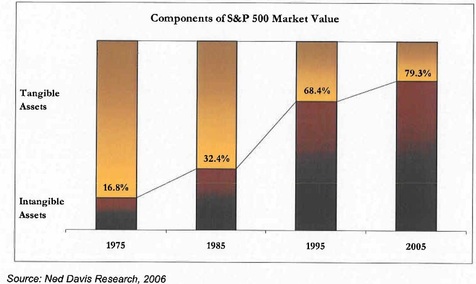

Economists estimate that two-thirds of the value of large businesses in the U.S. can be traced to intangible assets.[18] "IP-intensive industries" are estimated to generate 72 percent more value added (price minus material cost) per employee than "non-IP-intensive industries".[19][dubious – discuss] , as is illustrated by the following chart

Some pundits clearly think so, but given its leadership semiconductor technology, strong leading edge manufacturing infrastructure, and balance sheet, it is way too soon to call game over for Intel. But it would seem that Intel needs to introduce some real change in order to correct its course. Perhaps Intel should look back at what Andy Grove’s said and ask itself: does it really act like a paranoid company, or perhaps it is just the inverse.

We at MonolithIC 3D believe that the whole semiconductor industry is about to go through a major disruptive change. After 50 years of successful growth and progress by dimensional scaling, the time has come for a direction change, and the time is now for starting to embrace scaling-up, going for monolithic 3D. The current leaders in dimensional scaling, the NAND Flash vendors, seem to be leading the way. They are pushing ahead with monolithic 3D-NAND. This disruptive change will bring vast new opportunities, and those who will be early to embrace the change may be able to reap the IP reward.

RSS Feed

RSS Feed