Startups are going "The IP Way"

Yes, its true. Check out Fig. 1.... these are some of the best-known digital semiconductor startups in Silicon Valley today, and all of them have an IP business model!

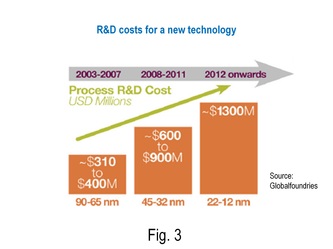

What I said in the previous paragraph is for a startup developing a new digital chip design. But if the startup comes up with a new transistor technology, for instance, the numbers get even scarier. Fig. 3 shows that a new transistor technology can take upto $1B to develop today!

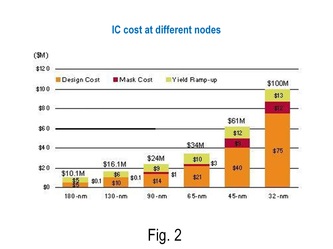

The trends I talked about in the last two paragraphs automatically point towards an IP business model. An IP startup develops patents and many times prototypes in a certain area and licenses this to others. The amount of investment needed for this is typically less than $10-20M, and one can potentially get a 10x return-on-investment by selling the startup company to a bigger semiconductor company for ~$100M-200M. Of course, these IP companies could also follow Rambus' example and do an IPO. Not just that, even big semiconductor companies are struggling to develop their own technologies and designs today, largely due to the trends in Fig. 2 and Fig. 3. An IP company that specializes in one part of the design or technology and provides this solution to multiple industry players is therefore viable.

Among the startups listed in Fig. 1, I am particularly bullish on Intermolecular. I hear talk that they are already profitable, and they have received excellent reviews from Elpida for developing their DRAM capacitor (see Elpida gains on rivals with R&D partner). The Intermolecular employees and executives whom I know are capable and hungry folks who're very good at process development. Am hearing rumors about them doing an IPO next year... watch out for this IP company!

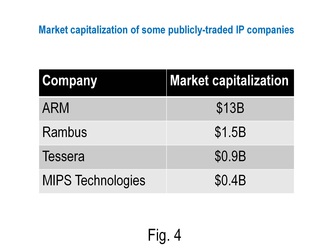

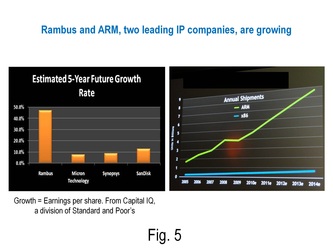

Just like TSMC pioneered the now-prevalent fabless-foundry business model, Rambus, Tessera and ARM pioneered the IP business model. The market capitalization of these IP companies is now staggering. Fig. 4 reveals ARM's valuation today is $13 billion! Growth projections for these companies are shown in Fig. 5. Analysts project forward EPS growth of Rambus to be much higher than the rest of the industry. The ARM architecture has seen exponential growth in the mobile space, and this growth is projected to continue moving forward too. These success stories are causing people to sit up and take note (of the IP business model).

An aside: If you haven't, you should check out Rambus' new office. It's on the 7th floor of one of Silicon Valley's tallest buildings, and you get an amazing view of the whole Valley from there (see the picture in Fig. 6). I call it a view from the top of the (IP) world :-)

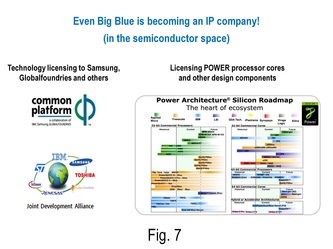

I'm talking about Big Blue, of course. IBM is indeed seriously thinking about the IP business model for its semiconductor business. As many of you know, Sam Palmisano, the IBM CEO, has been ruthless in his quest for increased gross margins. He's got rid of low-margin hardware businesses such as PCs and has increasingly made IBM a software and services company. IBM's semiconductor division has lost a lot of money over the years, and Sam Palmisano's been under pressure to do something about it. Here's what I think he'll do... over the next 5 years, IBM's semiconductor division could predominantly become an IP-play with two parts:

- A technology IP development team that invents, develops and licenses logic process technologies to Globalfoundries, Samsung, and others.

- A design IP team that develops Power processor cores, SRAM cores and other blocks and licenses these across the industry. IBM's mainframe and server divisions could use these Power processor cores and SRAM blocks to build systems, and they could also use these IP blocks to design high-volume chips for game machines.

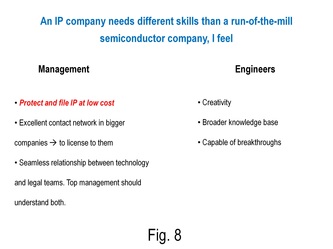

An IP business model may be advantageous in terms of investment and possibly even gross margins. However, it has its own challenges and to be successful, it needs management and engineers with very different skills. Here is my opinion of the skills required. Note that these are my own personal opinions, and do not reflect the thinking of my company...

Management skills required for running an IP company:

- As many of you know, legal costs form the biggest barrier to profitability for an IP company. With good IP strategy and careful drafting of patents, one can, however, reduce the amount of litigation one gets involved in (the potential licensor doesn't like going to court when his chance of winning the case is small). One can also keep lawyer costs down with some interesting ideas. IP strategy is one of the biggest strengths of Zvi Or-Bach, MonolithIC 3D Inc.'s CEO. Its amazing how much I've learned from him on this topic.

- When you're an IP company, you want to license to a whole bunch of companies across the industry. If your team's executives have a great contact network in these companies, that helps tremendously. For example, I heard Tyler Lowrey, the CEO of Ovonyx, managed to get his company off the ground in the 1990s since he had excellent contacts in Intel and ST Microelectronics and persuaded his friends there to start a project on phase change memory.

- In many big companies today, you have a legal team and an engineering team, with both of them mutually exclusive. When an engineer comes up with a new idea, he spends 30 minutes explaining his idea quickly to a patent lawyer and rushes off to his next engineering task. The patent lawyer, who is not a technical expert in that area, often writes something different from what the engineer envisioned. The engineer doesn't bother reading the 100 pages the patent lawyer wrote up and a bad patent gets filed in the Patent Office :-( In an IP company, on the other hand, things need to be very different. The engineer needs to be closely involved with preparing the patent and spend a lot of time understanding how the claims are written and help with preparing the specification and drawings. Management should make this happen!

- Engineers in an IP company need to have a slightly different skill-set than those in a standard semiconductor company. In bigger product companies, engineers need to pay more attention to detail and their focus should be to ship a product on schedule... creativity isn't as important as in an IP company, where producing new ideas and breakthrough patents is the most important thing.

- One thing I've noticed is that people who see the big picture and know about many different topics invent much more than those completely focused on one specific field or topic all their life. A few years back, I spent a few hours talking with Ravi Arimilli, an IBM Fellow who is one of the United States' leading inventors [read his wiki page]. Its amazing how broad his knowledge base is! I have found the same to be true for other well-known inventors such as Eli Harari, Vivek De and others. I think this broad knowledge base allows people to combine ideas from many different areas and produce innovation.

- Post by Deepak Sekar

RSS Feed

RSS Feed