These kinds of headlines are not seen too often in the semiconductor business domain and it is not clear what the objectives are for such. It will be hard to believe that this is an attempt to manipulate the investor community, yet there are only a handful of super high volume design wins that are driving the leading edge devices, and for those wins the fight should be taking place in the 'board' room. So let’s dive a bit into the details behind these headlines.

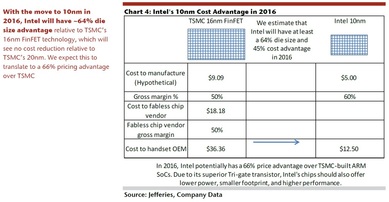

The first headline relates to Jefferies analyst Mark Lipaci releasing an analysis report stating: "Intel will have a die size and transistor cost advantage over Taiwan Semiconductor (TSM) for the first time by fourth-quarter 2014, which could lead to a 50% pricing advantage in processors in 12 months, and a 66% pricing advantage in 36 months". We can find more information in the blog titled: Intel: Primed for Major Phone, Tablet Share on Cheaper Transistors, Says Jefferies. Quoting Lipaci: "At the same time that Intel has started focusing on computing devices in mobile form factors, it appears that TSMC is hitting a wall on the transistor cost curve. The chart below was presented by TSMC’s CTO. We believe that due to Intel’s larger R&D budget, its recent focus on the mobile/tablet market, and its higher R&D spend relative to TSMC, that it will produce a lower cost transistor than TSMC for the first time ever in 4Q14. We believe Intel extends that cost lead 24 months after than in 2016."

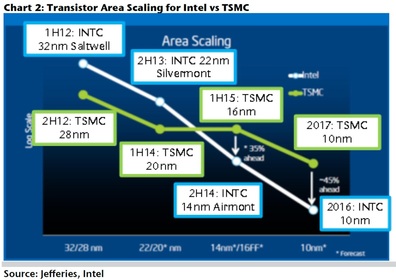

Lipaci then used the following chart to illustrate the build up of Intel advantage vs. TSMC.

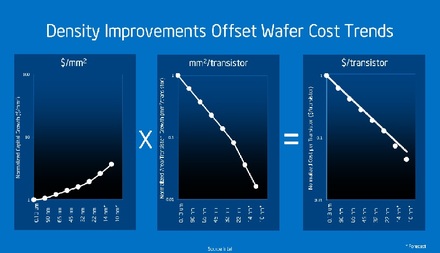

The charts above also compare Intel’s cost advantage vs. TSMC older nodes (Intel's 14nm vs. TSMC's 20 nm and Intel's 10nm vs. TSMC's 16nm). It is not clear that Intel is so far ahead. Intel 14nm had been delayed to the first quarter of 2014 and TSMC has committed to be in volume production in the later part of 2014. But the real competition is on the ability to bring fabless companies to volume using one's advanced process node. Key to this is the availability of libraries, EDA full tool set support, and major IP such as ARM processors. It is far from being clear that Intel is really far ahead of TSMC in this critical area. And then, these days it is not so clear that using a more advanced process node buys one an end-device cost advantage. In fact, the foundries have already made it clear that beyond the 28nm node they do not see cost reduction, due to the extra cost associated with advanced node lithography and other issues. Even Intel admitted at their latest analyst day that advanced nodes are associated with escalating depreciation and other costs, as illustrated by the following Intel chart - see the left most graph.

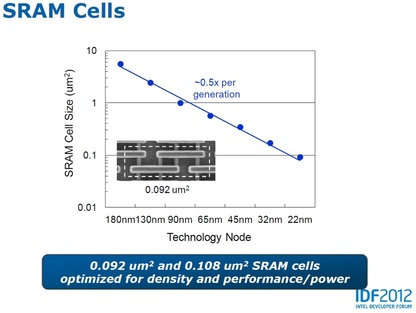

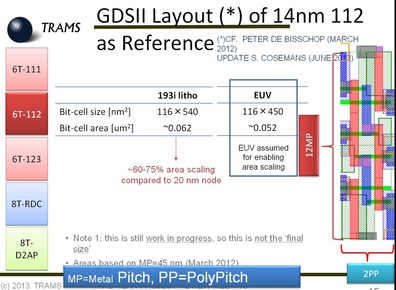

The simple indication of technology node effective transistor density these days would be the bit cell size. As we have presented many times before, modern SoC device area is dominated by the embedded 6T SRAM. At IEDM 2013, TSMC made public their 6T SRAM bit cell area for 16nm: 0.07 sq. micron. We could not find any Intel public release for their 14nm 6T SRAM bit cell size. We did find an Intel chart for older nodes. This 6T bit cell size chart was presented at IDF2012:

If Intel does have a really good number, it would be reasonable to expect that they will make it public soon, to entice the high volume fabless companies such as Qualcomm and Apple to explore Intel’s foundry option.

As for the Jefferies analyst assertion "We believe that due to Intel’s larger R&D budget, its recent focus on the mobile/tablet market, and its higher R&D spend relative to TSMC, that it will produce a lower cost transistor than TSMC", it is not clear if Intel’s R&D budget is truly larger. TSMC’s R&D budget is dedicated to the foundry side of the business while Qualcomm, Apple, ARM and many other fabless vendors R&D budgets support the design part of any new product release. The total ecosystem behind TSMC and ARM is clearly not smaller than that of Intel. In this month’s SEMI ISS Conference, IC Insights provided very interesting numbers regarding the record of 2013 as was reported in a blog titled:Is Intel the Concorde of Semiconductor Companies?

Top 10 CAPEX Spenders in 2013:

- Samsung $12B

- TSMC $11.2B

- Intel $10.5B

- GF $5.5B

- SK Hynix $3.7B

- Micron $3B

- Toshiba $2.9B

- UMC $1.5B

- Infineon $880M

- ASE (OSAT) $770M

- Samsung 12.6%

- TSMC 10%

- Micron 9.3%

- Toshiba 8%

- SK Hynix 7%

- Intel 6.5%

- ST 3.5%

- UMC 3.5%

- GF 3.3%

- TI 3.0%

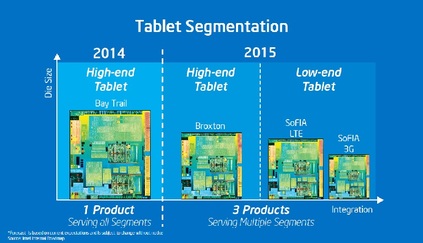

Cost is important but it is far from being the only parameter when choosing a foundry partner. Selecting a foundry partner is truly selecting a partner. The design of leading edge devices is a very costly and lengthy effort, and has a pivotal effect on the business success for the fabless customer. TSMC had built trustful relationships for many years with its fabless customers. It is not clear how easy it is going to be for Intel to become a trustful foundry partner. So far it seems that Intel is still a proud IDM that insists that its customer will support its branding like the "Intel Inside" campaign or the recent announcement of Branding the cloud: Intel puts its stamp on cloud services across the globe. Intel’s repeating emphasis of their transistor cost advantage vs. that of TSMC suggests that Intel considers TSMC as their main competition for the mobile and tablet business. But then their consistent offering of SoC products for the space, as illustrated by the recent Intel chart below, and the Jefferies' cost analysis above, suggests that Intel is actually an IDM competing with the likes of Qualcomm in this space. It may create concerns in the minds of potential fables customers.

RSS Feed

RSS Feed