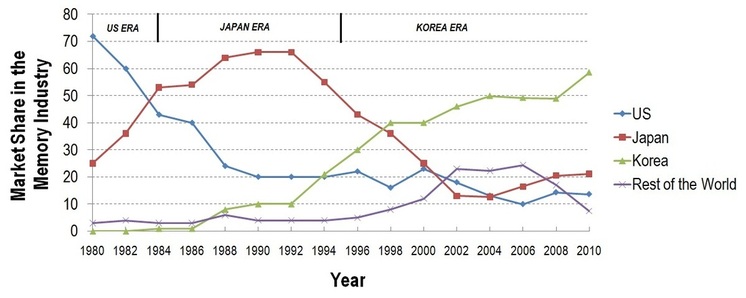

Like many researchers, I occasionally travel outside the country to attend conferences and give talks. I was in Korea for one such visit last week... It was my first time there, and I found it fascinating that such a small country contributes more than 50% of the world's memory output. Yes, its true, check out Figure 1. As the figure indicates, this Korean dominance was not sudden... it happened over a period of ten years between 1994 and 2004. Before that, Japanese chip makers (1984-1994) and American chip makers (before 1984) dominated the memory market. How did Korea achieve this phenomenal growth? Was it because of government policy, technical breakthroughs or economic conditions? Let's take a look...

Any study of Korean industry begins with an introduction to the chaebol business system. Chaebol are essentially a conglomerate of businesses, often owned by a single family. Through aggressive governmental support and finance, some chaebol have become well-known international brand names, such as Samsung, Hyundai and LG. For example, the Samsung chaebol includes semiconductors, consumer electronics, ship-building, financial services and a whole lot more, and is run by the family of Lee Byung-Chull, the founder of Samsung. As we'll see below, the chaebol business system is intricately linked to Korea's emergence as a dominant player in the memory industry.

Easy Access to Capital

South Korea, which used to be an agricultural nation, started an industrialization effort in the 1960s. The Government used a "guided capitalism" policy for this, wherein chaebol were selected to undertake projects, and were channeled funds from foreign loans. The government guaranteed repayment should a company be unable to repay its foreign creditors. Additional loans were made available from domestic banks. Not just that, semiconductor divisions of Korean chaebol were often provided capital by more profitable divisions of the conglomerate. This easy availability of capital was particularly important for success in the memory industry, which needed costly fabs and had long periods of losses.

To illustrate this point, let's look at Samsung. The company's average capital expenditure over revenues between 1987-92 was 39.8%, nearly double the industry average of 21%. In this period, the company also invested more than twice the amount of money in DRAM R&D compared to any of its competitors. The large investment helped Samsung become the world's biggest DRAM producer by revenue in 1992. Easy access to loans was the reason why Samsung had so much money to invest - its debt-to-equity ratio was 323%, which was more than twice that of similar American corporations.

Quick Transition to Next Wafer Size

Korean DRAM producers such as Samsung were some of the first to invest in larger diameter wafers. This strategy paid rich dividends, since equipment vendors provide discounts to the first few (risk-taking) customers. Let me give you some specific examples. In the early 1990s, the industry had an option to move from 6 inch to 8 inch wafers. The period coincided with a recession in the DRAM market, and Japanese chip makers were particularly hesitant to invest in 8 inch capacity. Samsung, which had abundant capital, had no such concerns and was the second company in the industry (after IBM) to move to 8 inch wafers. It got a 15% discount in 8 inch equipment prices, and benefited early from the 1.8x higher productivity of 8 inch fabrication. In the highly competitive DRAM industry, such a price advantage was invaluable. Similarly, in the move from 8 inch to 12 inch wafers in the early 2000s, Samsung led the way. As a result, it got a 24% equipment price discount and benefited early from the 2.3x higher productivity of 12 inch fabrication. This helped the company extend its market share lead in the early 2000s. No surprises why Samsung is investing aggressively in 450mm... its following a strategy that has worked in the past.

Capitalizing on Early Stages of the Product Life Cycle

Figure 2 shows a typical DRAM life cycle... it reveals how a 512Mb DRAM was sold at $11 for its first few months after introduction but reduced in value to $3 within three years. To take advantage of high prices just after introduction, ramping products to high yield quickly was a focus for Korean companies. And they executed superbly on this goal. 80% yield numbers were sometimes reached just after manufacturing started. This was because Korean companies had a system wherein yield could be estimated and improved even in the development phase... (as you'd know, in the rest of the world, yield is frequently optimized only in the manufacturing phase)

Low Cost Manufacturing Location

Korea is a lower cost manufacturing location than the US and Japan, and this factor played an important role in its emergence. Corporate income tax in Korea is in the 25% range, compared to 35-40% in the US and Japan. Furthermore, the Korean government gave 5-10 year tax holidays and low interest rate loans to chaebol. Labor costs were significantly lower in Korea as well. In the highly competitive memory industry, these advantages were priceless.

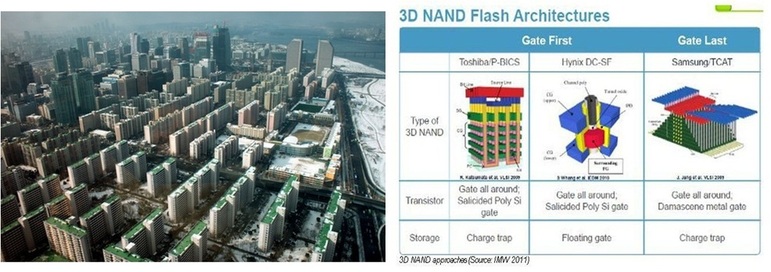

There are a few more reasons why Korean companies became dominant in the memory industry, but I'll save them for later. Before we end, let me talk a bit about the future. As you'd know, Korean companies were not around in the 1970s and 1980s when basic ideas on DRAM and flash memory were developed... due to this, they often had to license core memory patents from other companies and pay royalties. To ensure that they have a good patent position in future memory technologies such as RRAM, PCM, MRAM and monolithic 3D, Samsung and Hynix have invested large amounts of money in research. Several breakthroughs from these companies have been presented in top semiconductor conferences recently. In particular, during my visit to Korea, I was happy to see 3D applied to many markets - right from construction to NAND flash memory. Yup, you read the last sentence right - I did say construction. Korea has some of the highest density of skyscrapers in the world. See Figure 3. The Koreans certainly believe the third dimension is the way to go!

References

[1] Creating first mover advantages - the case of Samsung Electronics, by J-S. Shin and S-W. Jang

[2] A Study of the DRAM Industry, by J. Kang

RSS Feed

RSS Feed