Like many semiconductor enthusiasts, my day begins with a look at EETimes. Imagine my surprise a few days back when I saw a story about Intel, TSMC, IBM, Samsung and Globalfoundries joining forces to do 450mm chip R&D in New York (Figure 1)! Now, as we know, the 300mm to 450mm wafer transition can produce around 20-25% cost savings if all goes well. That raises the question: Are rivals such as Intel, TSMC and Samsung working together just to get 20-25% cost savings? Or is there more at stake?

Let's analyze the situation...

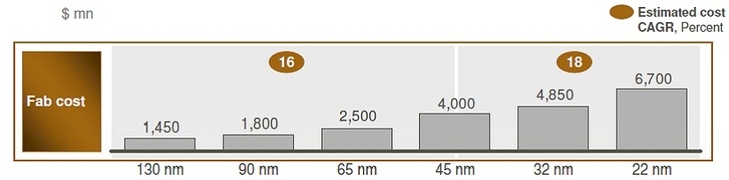

Figure 2 shows a plot of logic fab cost as a function of feature size. Does Figure 2 mean that a transition from 32nm to 22nm will cost companies $6.7B? No. Most tools from a 32nm logic fab can be reused for 22nm, and only a small percentage of new tools need to be bought. Companies such as Intel typically spend less than $2B when upgrading a single fab from 32nm to 22nm logic technology. (There are some exceptions to the rule, of course, but we'll talk about that in another blog post)

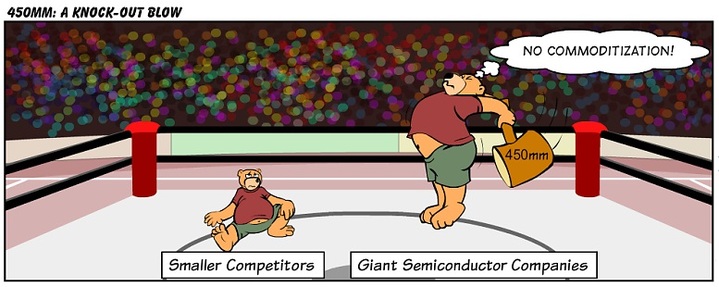

Moving to a different wafer size, such as 450mm, fundamentally breaks this model. When you move to a new wafer size, you need to upgrade ALL the equipment in your fab. This essentially means that you need to cough up $7B. You can't get away with paying just $2B. This requirement for large amounts of capital during wafer size transitions has caused many small players to exit the industry in the past. TSMC, in its paper titled Economic Analysis of 450mm Wafer Migration says, "The capital investment for larger wafer size fabs is increasing significantly, which creates an entry barrier to knock out weak players. For IC makers, about 130 companies had owned 150mm fabs. That number dropped to fewer than 90 for 200mm fabs and to about 24 for 300mm." It seems but natural to expect this trend to continue at 450mm.

A rule of thumb people use is that your revenue must be at least 2x greater than your fab cost to be able to afford it. To pay for a $7B 450mm fab, your revenue must therefore be at least $14B. Let's look at the different market segments in semiconductors and find out who can afford 450mm fabs.

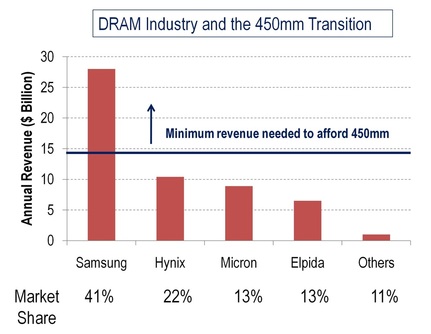

In the DRAM business, only Samsung makes the cut, as Figure 3 indicates. All other DRAM makers, who together make up 60% of the DRAM market, may be unable to afford the 450mm transition. Their costs are therefore going to be ~25% more than Samsung, which is quite significant for DRAM. Not just that, equipment makers are not expected to support scaling on 300mm after the transition to 450mm. For example, no immersion litho tools are available for 200mm wafers now that the transition to 300mm has occured. This prevents 200mm manufacturers from scaling to small feature sizes. Due to the above reasons, a DRAM manufacturer who doesn't move to 450mm may eventually have to exit the business.

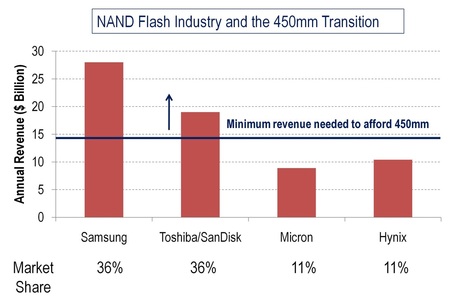

In the NAND flash memory business, only Samsung and Toshiba/SanDisk may be able to afford 450mm fabs (Figure 4). All other manufacturers, who together make up 28% of the flash market, may be unable to afford 450mm and may eventually be forced to exit. Expect to see many of the smaller players in DRAM and NAND flash try and get national governments to pay for 450mm fabs to stay relevant. Also expect to see more alliances between manufacturers...

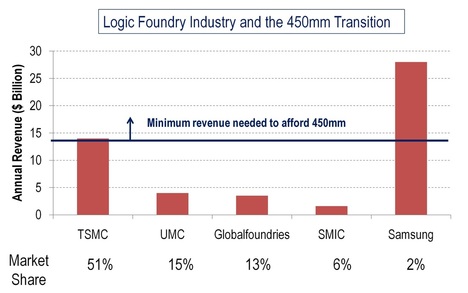

In the foundry business, only TSMC and possibly Samsung can afford a 450mm fab, as Figure 5 shows. Globalfoundries, as we know, is lucky enough to be sponsored by the Government of Abu Dhabi, who could potentially get them a 450mm fab. The other foundry players, who make up 36% of today's foundry market, may be unable to afford a 450mm fab :-( Foundries who cannot afford 450mm may need to remodel themselves as analog/RF/trailing-edge node suppliers.

How would this new world with possibly one low-cost DRAM producer, two low-cost NAND producers and two or three low-cost foundries look? Well, in this new world, semiconductor products would no longer be commodities. Yes, even memory products such as DRAM and NAND flash could become decommoditized. Let me explain why... Memory prices are determined by how competitive the market is. In a world with just one or two competitive memory manufacturers, it is possible that these manufacturers could boost their profit margins quite significantly. Needless to say, logic manufacturers would reap significant benefits from having less competition too.

The 450mm transition hasn't found much favor with equipment makers yet, since it doesn't exactly increase their market. Some equipment makers say 450mm may never happen. But expect Intel, Samsung and TSMC to push aggressively for it. And they'll push for it not just because it reduces costs by 20-25%... they'll push for it also because it helps them force out competitors and boost profit margins. In fact, one of the biggest proponents for 450mm seems to be Morris Chang of TSMC. The old warhorse, who is considered the Andy Grove of our times, has no doubt seen what I'm describing to you above. A decommoditized semiconductor business would be wonderful, wouldn't it? At least for the ones left standing at the end of it all...

RSS Feed

RSS Feed